After many years of just a trickle of work being offered through my husband’s union hall, the Columbus area is now booming with an influx of construction jobs. So much that jobs are actually sitting on the window at the hall unfilled. I have to say, it’s a great spot to be in, in the moment, but I know that with the cyclical nature of construction booms, it’s only a matter of time before it’s back on the downswing. After all, it was less than a year ago that the possibility of a layoff was always looming over our household, a very stressful spot to be in.

It feels like we’ve experienced more than our fair share over the years… A layoff is never convenient, but some times are definitely less convenient than others. There was the time my husband was laid off the day before Christmas Eve. And there was also the time that he received his notice the day after Christmas. And the worst of all — when he literally got laid off via a voicemail while we were in the delivery room, as I was giving birth to our fifth child.

I mention all of this because I believe many of you are in the same situation. Despite the falling unemployment rate, I know that those numbers are somewhat skewed by workers who’ve simply given up looking for a job. So I thought this might be a good time to bump up these tips for what to do if job loss is a possibility and what to do if you lose your job…

If a job loss is still just a possibility:

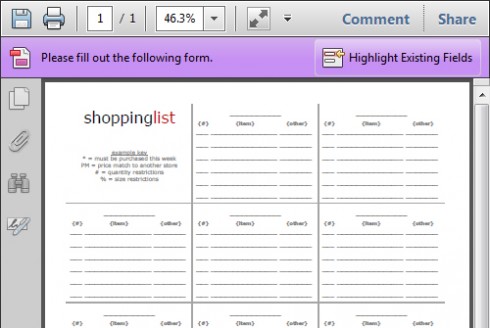

Cut back your spending immediately. Review your bills and look for areas where you can start to scale back. Start small by trying to cut just $1 a day from your expenses and increase your savings from there. Learn how to maximize your savings at drugstores and grocery stores and add these additional funds to your emergency account.

Consider purchasing supplemental income insurance. SafetyNet is among the simplest forms of insurance. It will pay you a lump sum in the event of a layoff or other unexpected job loss! The premiums are surprisingly affordable, starting at just $5 per month. If you need to file a claim, the payout can be used for anything you wish – rent, groceries, utilities, whatever you need. Signing up is easy with just three simple questions, no credit checks.

Build a stockpile. Hopefulone and Erin both wrote excellent guest posts on this topic. In the event of a layoff, being able to cut back your grocery expenses by eating from your stockpile is a huge blessing.

Pay yourself first. Start building an emergency savings by setting up an online savings and having money automatically drafted into it from your checking account each pay period. Transfer the money saved from any cut backs into it as well. Every little bit helps!

I also can’t recommend the book Profit First enough. I’ve been using the method discussed in it for about 6 months now, and it’s totally transformed both my business and personal finances.

Start paying just the minimums on any debt. While not ideal for getting out of debt, this will help with your immediate cashflow. Funnel anything extra you were paying into your emergency account for the time being.

Get a handle on the job market. Check out the classifieds and online job postings. Start doing a little networking to feel out the situation in your industry, and update your résumé so it’s ready to go.

If you lose your job:

Negotiate for additional benefits. Most companies will offer the standard severance of unpaid vacation and a good reference, but you may be able to haggle for more. Ask for additional compensation based on years of employment, extended health benefits, or reimbursement for job placement services. It’s likely that companies will be willing to provide one or more of these to avoid negative publicity. You won’t know unless you ask!

File for unemployment. Generally you should do this immediately because there’s a one-week holding period; however, from experience I can tell you there’s one exception to that. If it’s close to the end of the year, it might be in your best interest to wait until the new year. Compensation rates often increase every year, and by waiting a few additional days you may be entitled to more money. We learned this the hard way when my husband filed back in 2005. If he had waited a mere four days, we would have received an additional $40 per week in compensation. Check with your state agency, and if you can stick it out for a few days, do so.

Communication is key on all levels. Let your family members know about your situation. Explain to your friends that you’ll have to cut back on entertainment expenses for a while. Get the word out to your social network. You might be surprised by a job lead from an unexpected source. Finally, contact your creditors immediately if you see yourself starting to fall behind on your bills. They may be able to offer some sort of temporary solution.

Seek out additional resources. These may vary by location, but it’s a good idea to see what’s available. Don’t EVER be embarrassed to take advantage of whatever programs are available to you. There’s no shame in doing what it takes to keep your family from financial disaster.

A few to consider:

- WIC

- Food stamps

- Medicaid in your state

- Food pantries

- Energy assistance programs

- Your church

Your state department of job and family services may have additional suggestions. Don’t be afraid to ask your unemployment case worker what you’re eligible for.

Cut back your budget to all but the necessities. When it comes right down to it, things like cable, cell phones, and Internet can probably all be eliminated. Look for free sources of family entertainment such as free DVD rentals from Redbox. You might be surprised at what you can do without when it really matters.

Start looking for a new job immediately. Take advantage of any outplacement resources offered by your former employer. In most cases you will be required to report on your job search regularly to your unemployment caseworker, so you’ll want to maintain a log of companies you apply with and any responses you receive.

If you’re a union worker, as is my husband, you may be in a different position. He must wait until his layoff number on “the list” is high enough to win a bid on a job. I know the particulars vary by union, but in our case looking for work outside the union could mean thousands of dollars in fees and fines.

Be sure to stay in close contact with your union hall’s hiring manager, and ask about any additional resources that your hall may have to offer. You may be able to take a travel position and work out of another union, as my husband has done on several occasions. Or this might be a good time to take advantage of any continuing education programs available to you. Additional certifications could make you more valuable to employers and therefore less likely to be low on the list when layoffs occur in the future.

When you find new employment:

Keep your frugal ways in place for a while. Pay off any debt accrued during your unemployment period, build your emergency savings back up, and better prepare yourself financially in the event that it turns out not to be a good fit or for future cutbacks.

There’s no such thing as job security these days. Especially with the fluctuating economy, it’s important to be prepared as best as you can be for a sudden loss of income. Losing a job is never easy, but you can definitely prepare yourself so that it’s more manageable.

I certainly would not wish a layoff or job loss on any one of you, but I hope that these tips give you some hope in the event that you should need them.

Have you survived a major loss of income in your family? Do you have any additional tips to share?

This is a sponsored conversation on behalf of SafetyNet; all opinions and text are my own. Thank you for supporting the brands that support this site!